Investing in Africa – An Introduction to the African Forestry Landscape

Responsibly managed plantation forestry in Sub-Saharan Africa has the potential to offer attractive returns for development finance institutions and institutional investors.

New Forests launched an African Forestry Strategy to allow institutional clients to access these potential returns and take advantage of the positive tailwinds we see for the sector, including:

- Rising demand for all types of wood products from a growing and gentrifying population;

- The potential for higher value import substitution;

- Urbanisation and housing demand;

- Carbon market opportunities;

- Institutional investors increasingly being attracted to the sector from an expansion of green initiatives, with capital being deployed for sustainable development outcomes.

Integrating plantations into sustainably managed landscapes can also lead to climate change mitigation through forest protection, restoration, and biodiversity enhancement. Further, focusing on sustainable development outcomes can also bring the added value of economic and social opportunities for local communities.

Key takeaways for forestry investors in Sub-Saharan Africa

Forestry in Sub-Saharan Africa (SSA) has a long history that dates back thousands of years. Indigenous people across the region have relied on natural forests for their livelihoods, providing them with food, shelter, medicine, and other essential resources.

In recent years, the SSA timber sector has grown into an asset class that can offer a stable, long-term investment return, with little direct correlation to the performance of other asset classes.

As it has become more recognised as an asset class, state and privately-owned timber assets have been purchased and/or leased by dedicated investment funds, facilitated and managed by timber investment management organisations (TIMOs). Typical investors in these projects include development finance institutions (DFIs), pension funds, family offices and high-net-worth individuals.

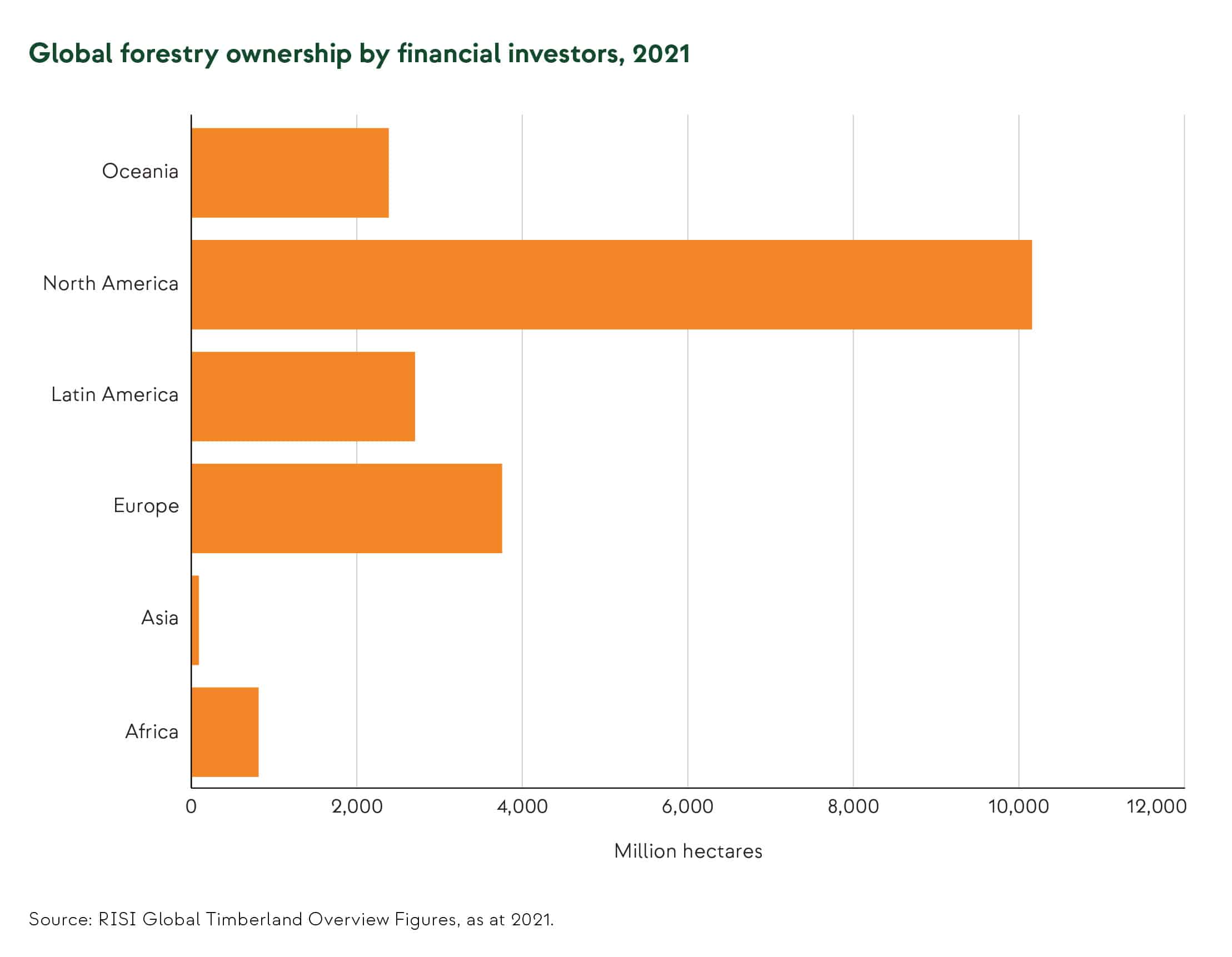

The chart below demonstrates global forestry ownership by financial investors in Africa. As shown, ownership by financial investors is much less developed than other regions. Much of the natural forest timber resources have been depleted and there is a need for capital investment to establish sustainable timber plantations and associated wood processing industries. Whilst Africa may have higher investment risk characteristics, it is expected to benefit from rising demand for all types of wood products from growing demographics, a developing economy and urbanisation.

To read a copy of the full paper, please download here.