Forests are home to most of the world’s biodiversity, store more carbon than is in the atmosphere, and support the livelihoods of billions of people around the world. However, in much of the world deforestation, forest and land degradation, poor agricultural practices, and soil loss continue.

As a result, the risks for investors associated with the degradation of natural capital are intensifying, including risks to supply chain performance, decline in asset value, physical security and business continuity, and social license to operate.

To create a sustainable future, investment must instead be channelled into strategies that protect and restore ecosystems and improve the management of working lands.

An investment approach that takes into account the needs of people and builds natural capital, is good for business, good for investors and good for communities.

By 2030 New Forests want to see all capital allocations to forests and other land use invested in strategies that create climate-positive and nature-positive landscapes, meaning that they integrate conservation, restoration, and sustainable production and generate shared value for communities.

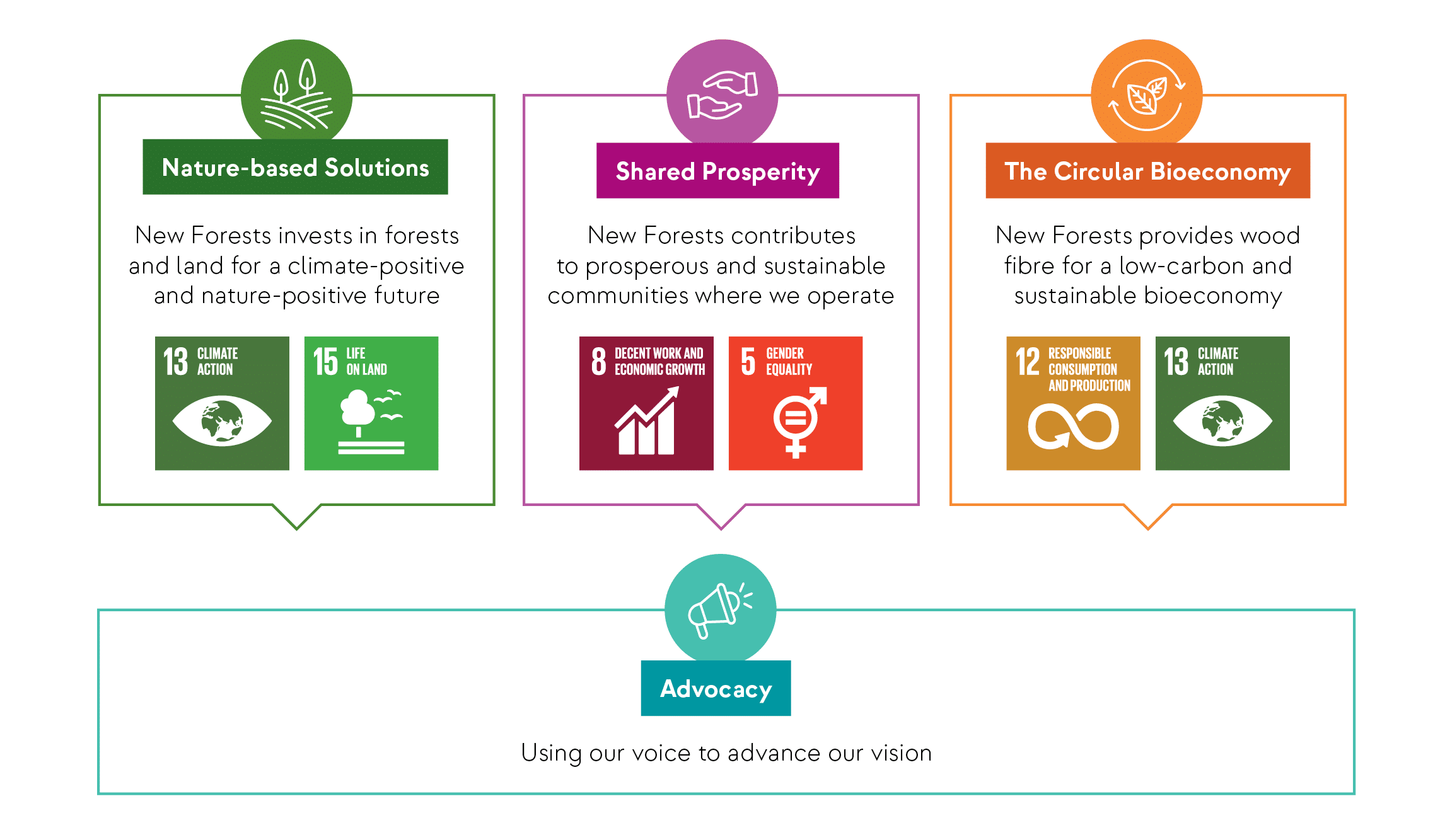

To advance our 2030 vision, New Forests’ investment strategies seek to create positive ESG impacts at scale in three areas: Nature-based Solutions, Shared Prosperity, and the Circular Bioeconomy. We will also use our voice through advocacy, working with governments, industry, and civil society to amplify our influence and advance our vision.