Harmonising Profits and Planet

Addressing climate change is not merely a choice; it’s an imperative that beckons us with boundless opportunities.

The significance of this mission cannot be overstated. Climate change threatens our planet’s delicate balance, our economies, and the well-being of generations yet to come. However, hidden within this challenge is the potential for transformative change. The burgeoning need for decarbonisation represents our chance to revolutionise industries, stimulate innovation, and craft a sustainable world that promises benefits for all.

Decarbonisation, in its essence, is the process of reducing and ultimately eliminating carbon emissions from various sectors of our economy and daily lives. It’s the transition from relying on fossil fuels, which release carbon dioxide and other greenhouse gases into the atmosphere when burned, to cleaner and more sustainable energy sources and practices. By curbing carbon emissions, we directly address the primary driver of global warming. This not only helps slow the rise in global temperatures but also mitigates the associated environmental catastrophes, from more frequent and severe natural disasters to the disruption of ecosystems and biodiversity loss. Decarbonisation isn’t just a means to an end; it’s a fundamental shift that empowers us to shape a sustainable future where clean energy, innovative technologies, and responsible practices lead the way.

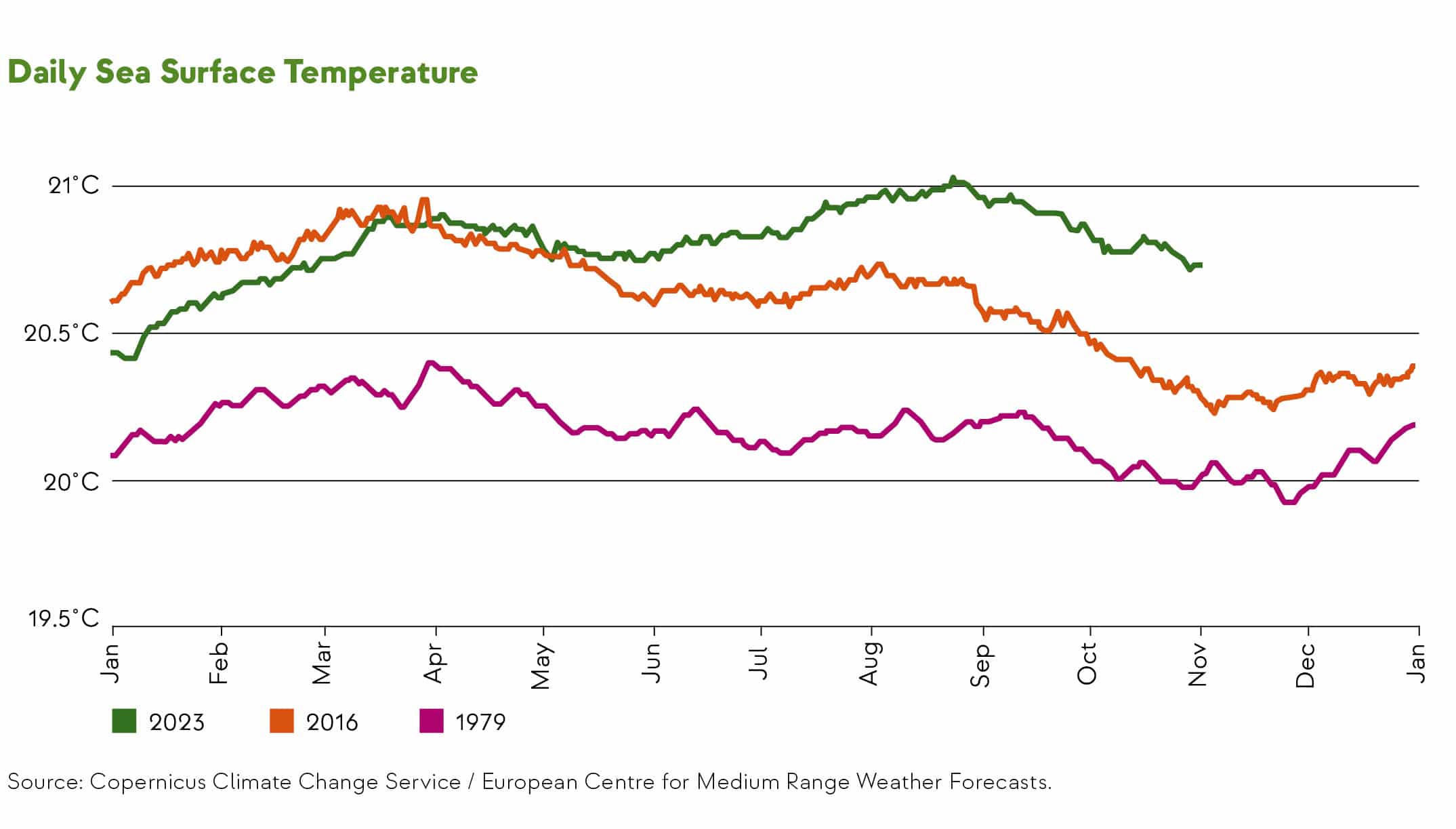

In September 2023, the world passed 1.5ºC of warming. Two months later, we reached 2ºC of warming above pre-industrial levels, according to the Copernicus Climate Change Service, with the temperature in November 2023, 2.07ºC above the 1850–1900 average. The chart below shows a comparison of daily sea surface temperatures during 1979, 2016 and 2023.

As investors look to invest in Nature Based Solutions (NBS), they need to understand how to value and manage the climate benefits as an asset. Carbon credits are a way to create an economic value for a NBS investment by channelling finance into the protection of nature within the management of a landscape or by a reduction of emissions. Carbon credits are the essential “net” in net zero where corporates and organisations use limited carbon credits to balance their unavoidable residual emissions.

To read a copy of the full report, please download here