Investing in the Circular Bioeconomy Transition: Sustainable Food, Fibre and Energy

This article explores how agriculture and forestry can become central to a climate- and nature-positive future. It highlights the investment opportunities emerging from the shift to renewable, circular systems—where biological resources are used more efficiently, waste is minimised, and sustainability becomes a driver of growth.

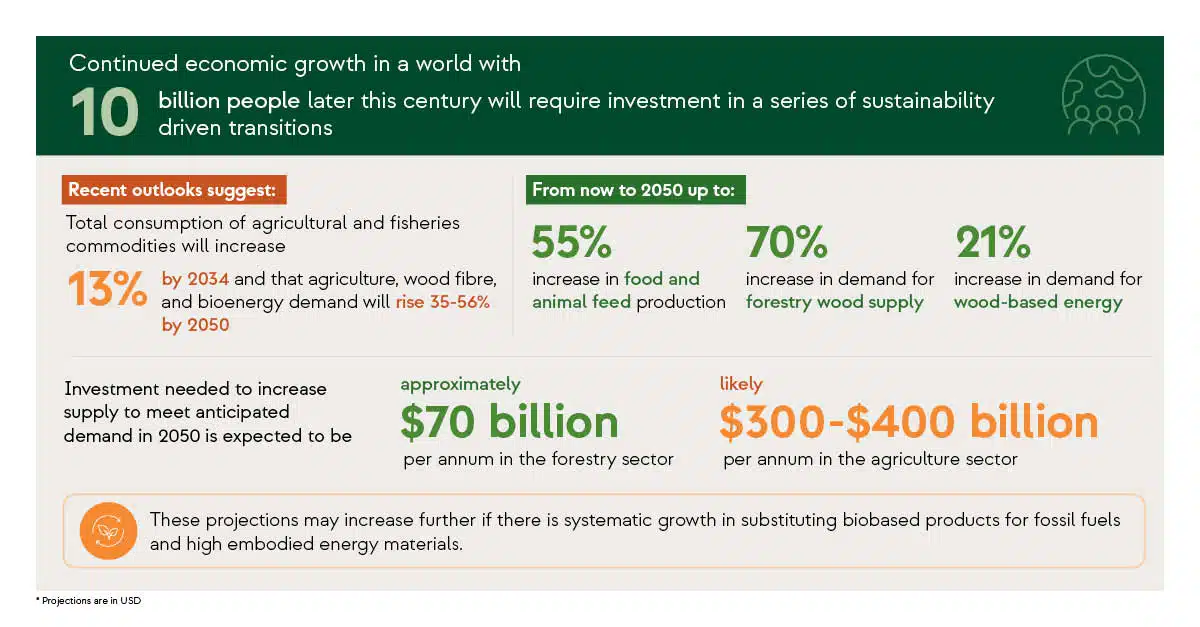

As global population growth continues and environmental pressures intensify, the need for a fundamental transformation in how we produce and consume food, materials, and energy is becoming increasingly urgent. The circular bioeconomy offers a powerful, yet practical framework for this transformation. One that prioritises renewable biological resources, minimises waste, and integrates sustainability into the core of economic systems.

In our latest article, Investing in the Circular Bioeconomy Transition: Sustainable Food, Fibre, and Energy, we examine how agriculture and forestry serve as foundational sectors in this transition. The paper explores the scale of future demand, the innovations required to meet it sustainably, and investment strategies that can support a climate- and nature-positive future.

The circular bioeconomy is more than a concept; it is a strategic imperative. It encompasses a wide range of technologies and practices, from mass timber construction and precision fermentation to bioplastics and regenerative agriculture. These innovations are not only reshaping supply chains and production systems, but also redefining how investors think about risk, resilience, and long-term value creation.

Public policy plays a critical role in accelerating this transition. Governments around the world are beginning to implement bioeconomy strategies, reform building codes, incentivise biobased alternatives, and support infrastructure development. At the same time, investors are increasingly seeking opportunities that align with climate and biodiversity goals, and offer exposure to emerging markets and technologies.

Yet, the transition is not without challenges. It raises important questions about land use, biodiversity, equity, and the pace of technological change. It also requires rethinking traditional investment models to account for new forms of value (such as carbon, water, and biodiversity) and integrating nature restoration and conservation into financial decision-making.

This insight article invites investors, policymakers, and sustainability professionals to explore the circular bioeconomy as a dynamic and multidimensional opportunity. It is a chance to invest in systems that are not only productive and profitable, but also regenerative and resilient.

Read the full article: Investing in the Circular Bioeconomy Transition

" />

" />